Help Card Credit Score

Prepaid credit cards dont have a credit line attached to them and they arent reported to the credit reporting agencies so they wont help improve your credit scores.

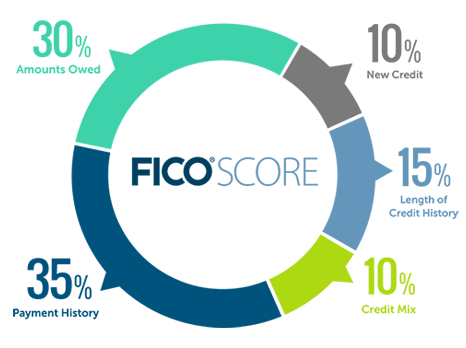

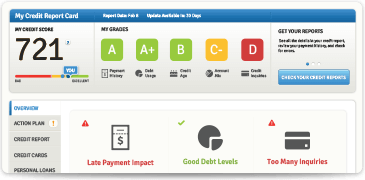

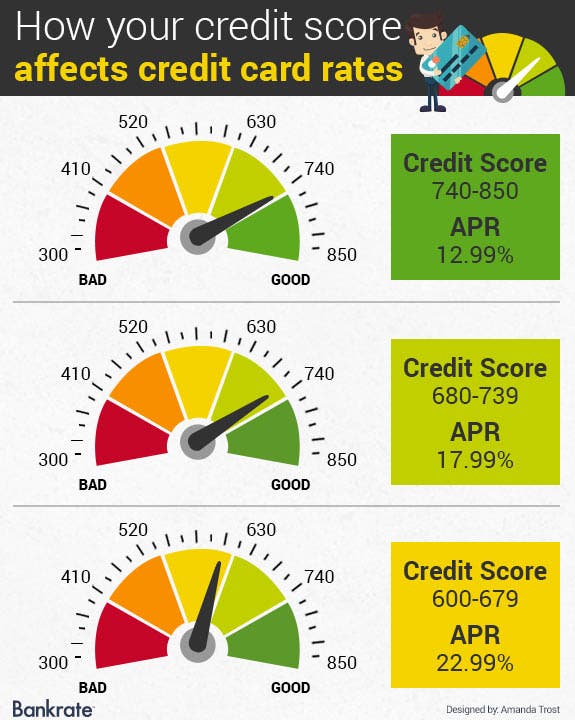

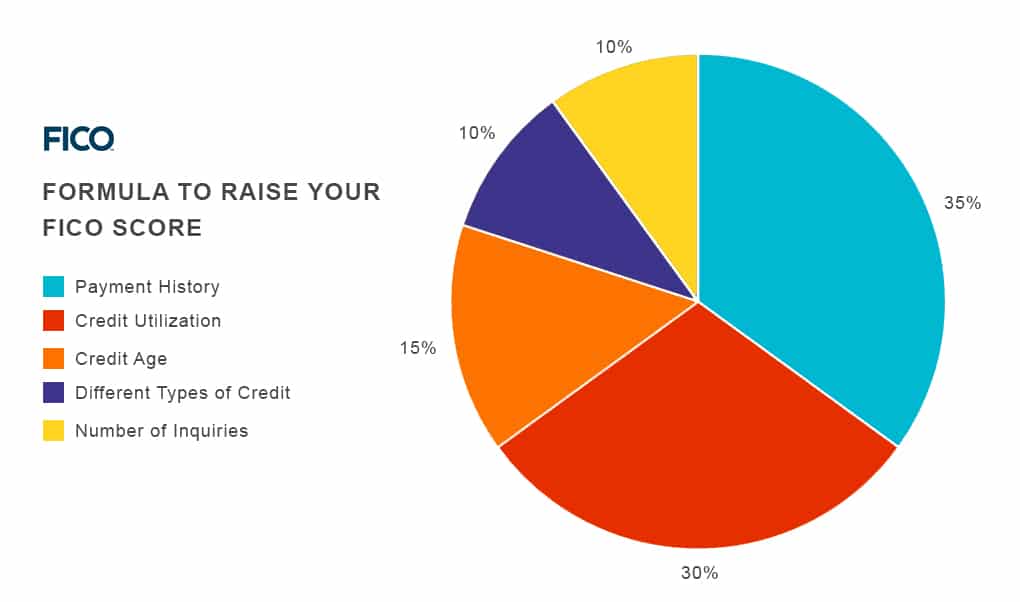

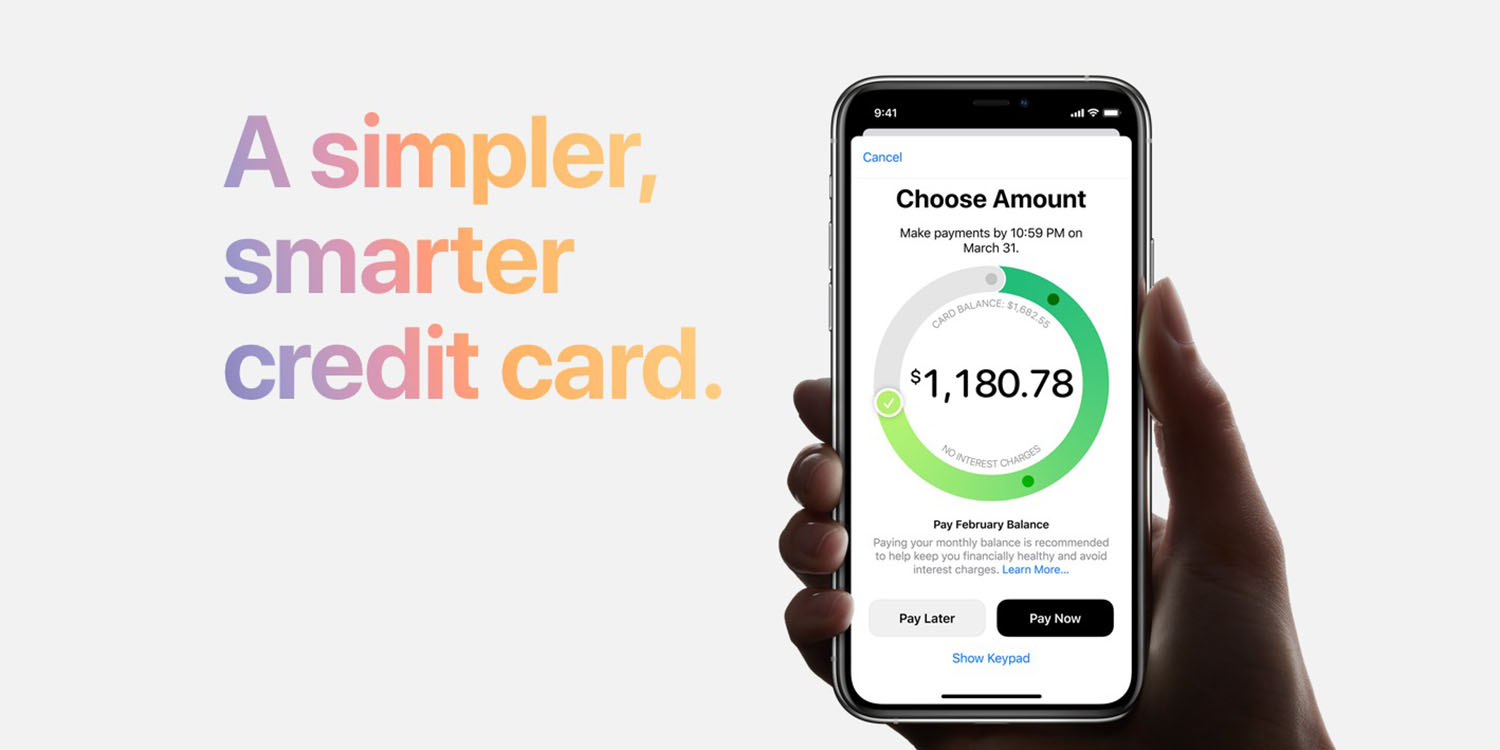

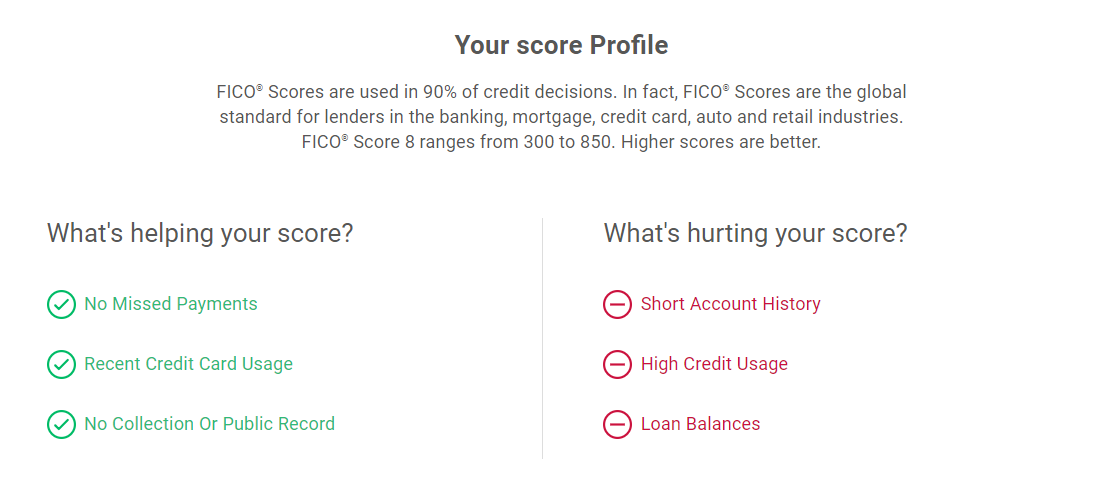

Help card credit score. If you want to improve and maintain a good credit score its more reasonable to keep your balance at or below 30 of your credit limit. Real people ready to help chat inapp or by phone. Larger payments reduce your balance faster and can help boost your credit score. The credit card offers that appear on this site are from credit card companies from which we may receive.

If you open a new credit card that comes with a credit limit of 5000 youd. 100 freeno gotchas no catches. Free credit score free digital banking. Pay down debt rather than just moving it around as well as.

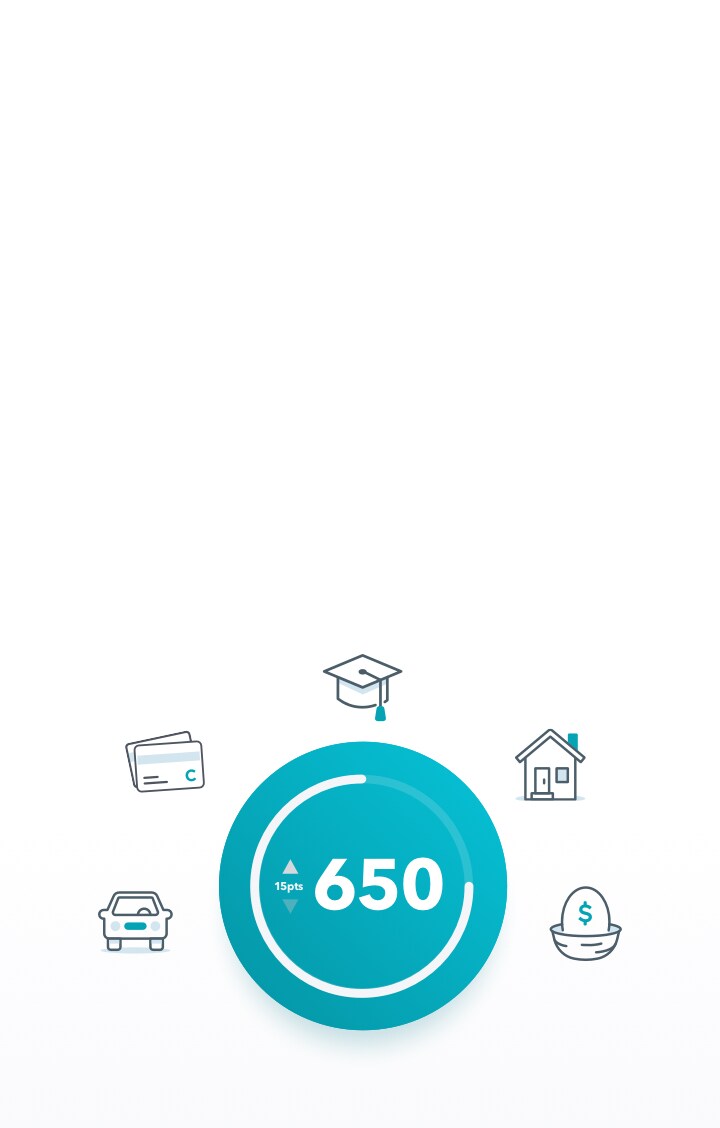

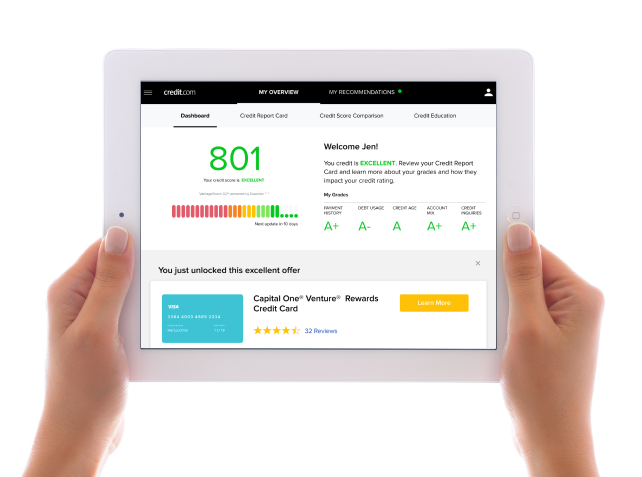

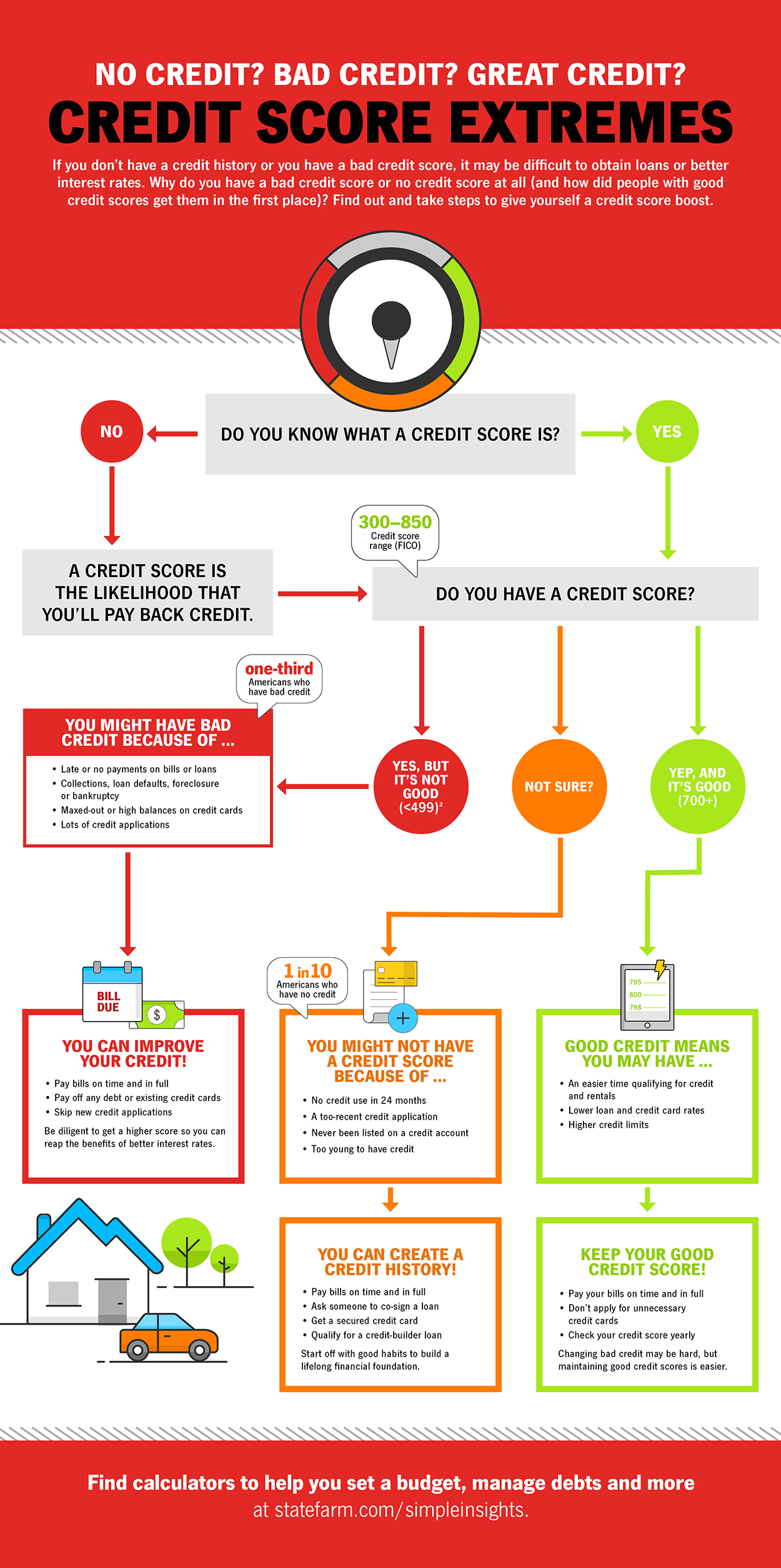

Credit monitoring with free digital banking. For example that means your credit card balance should always be below 300 on a credit card with a 1000 limit. If you have been impacted by covid 19 our team is here to help. Knowing your credit score before applying for a loan or any type of credit can help you better prepare and eliminate surprises such as unfavorable terms or even denial.

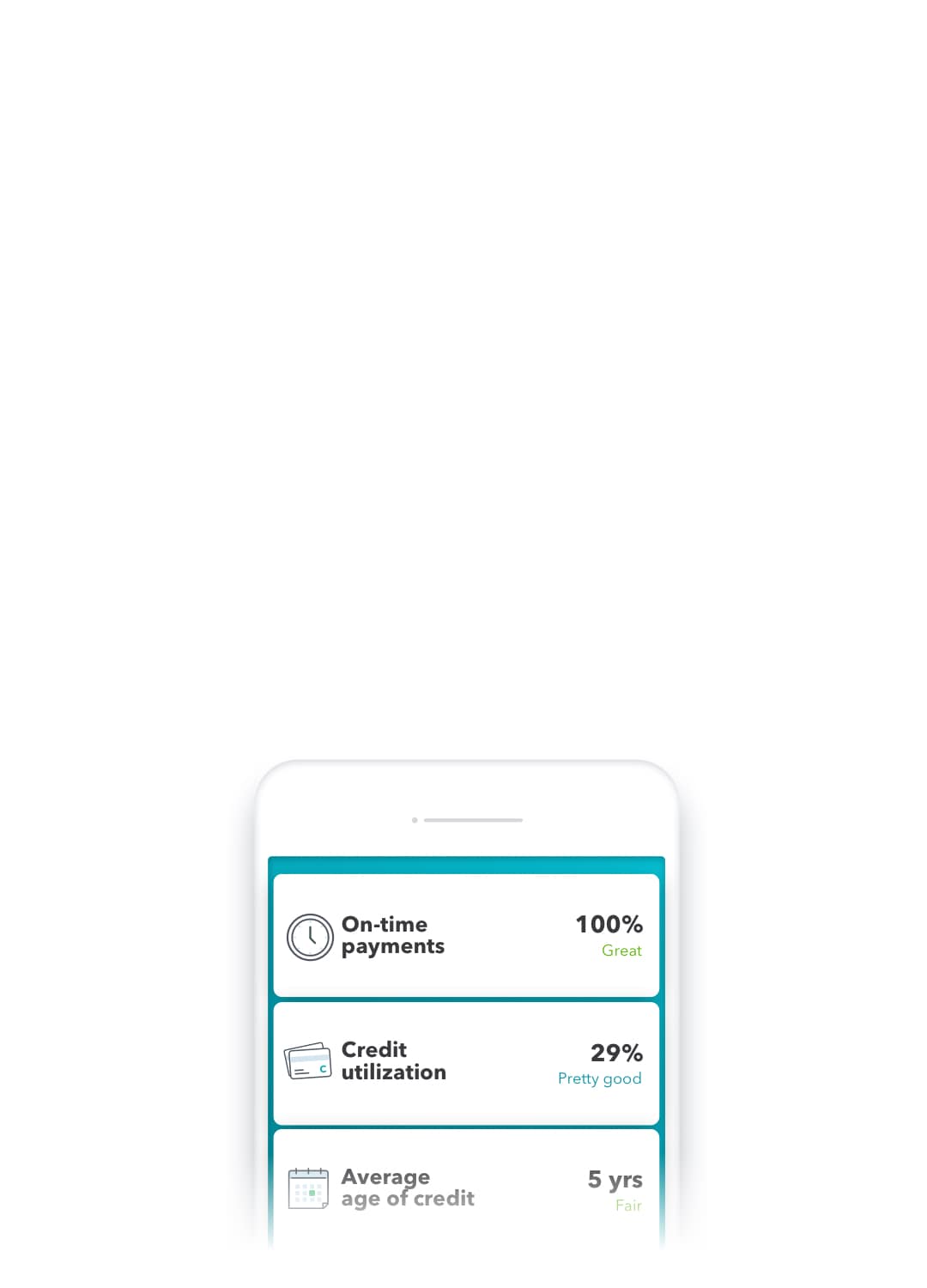

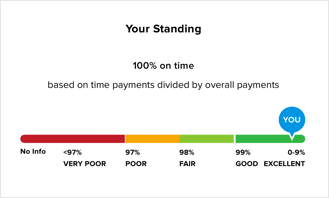

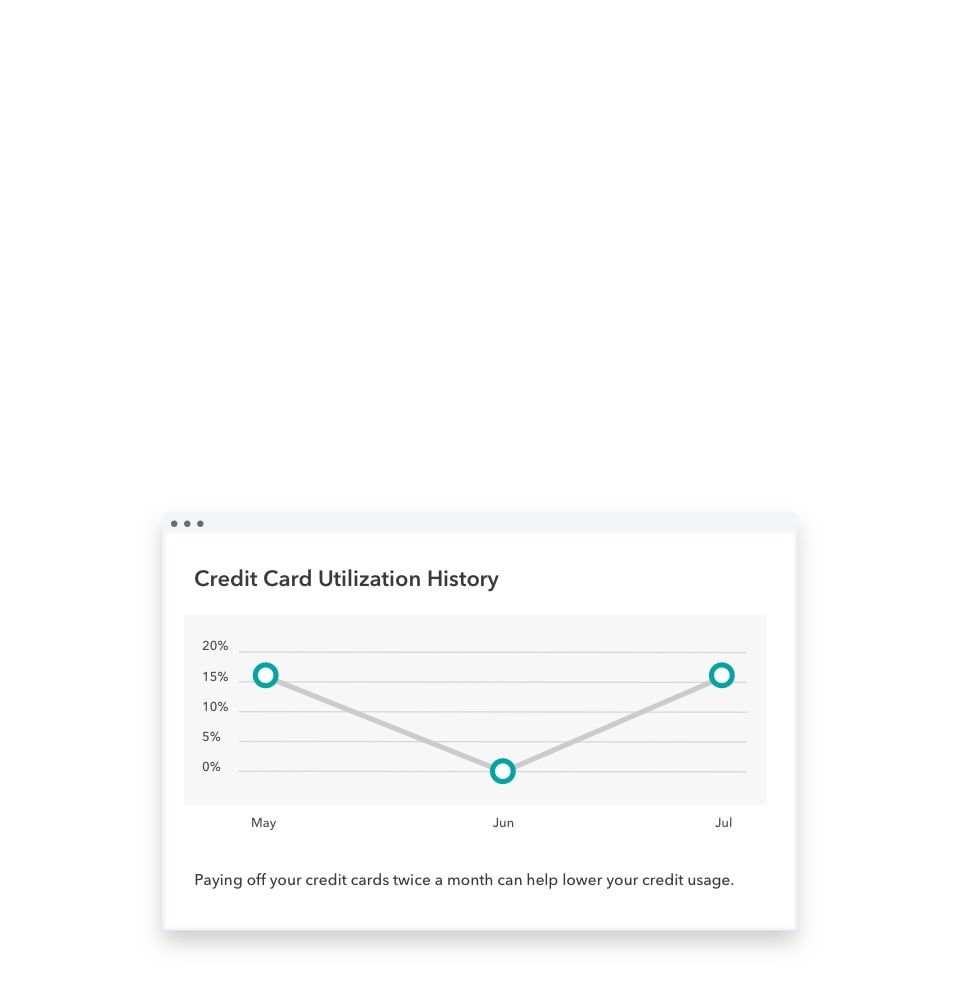

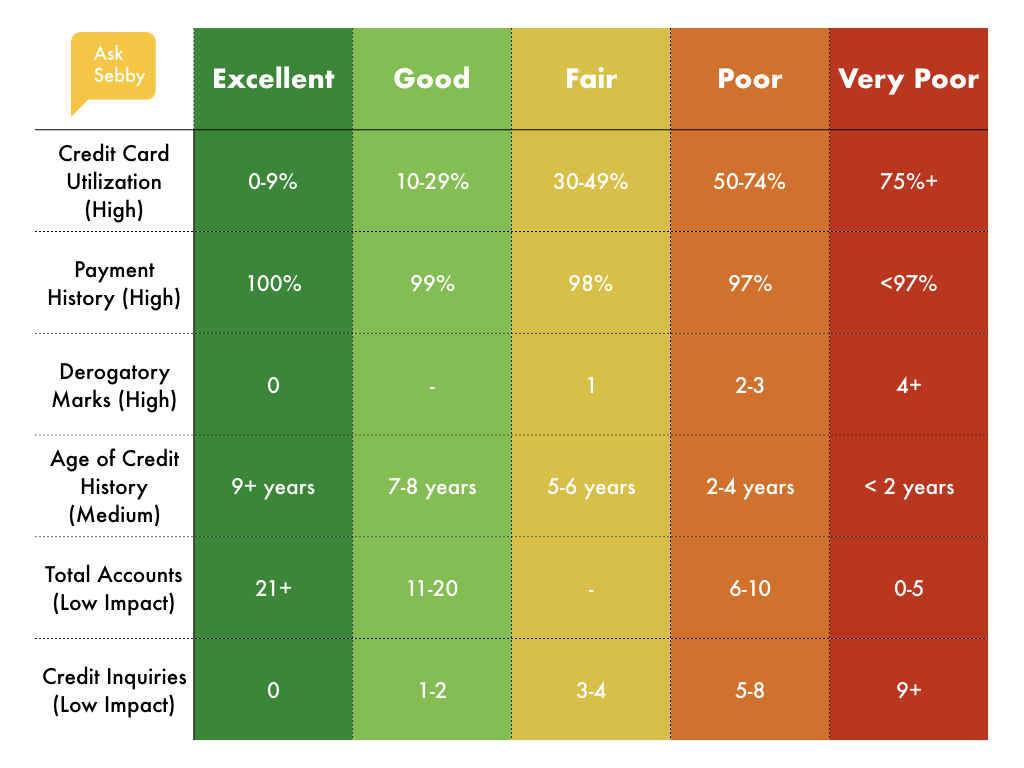

To maintain a good credit score youll need to keep this number to 30 or less and ideally 10 or less if possible. Approved or otherwise endorsed by any credit card issuer. Although prepaid cards and traditional credit cards often look the same and are used the same way when making purchases prepaid cards cant help you establish your credit history. Making multiple credit card payments can be beneficial.

Paying your credit card balances in full each month isnt just good for your credit scores. It also means you wont be spending money on interest fees. Many people assume that opening a new credit card will hurt your credit score but having more credit cards can actually lead to a higher score over time. Contact live life now you.

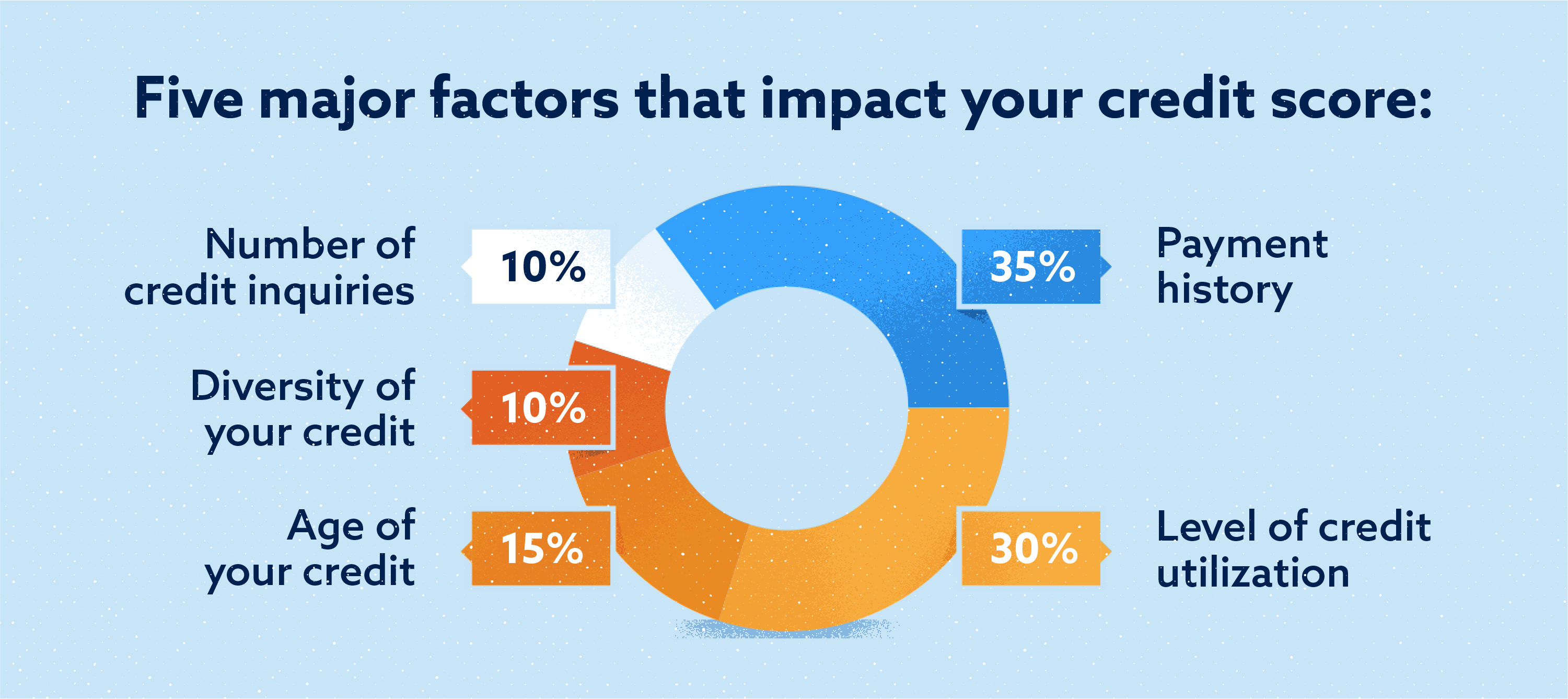

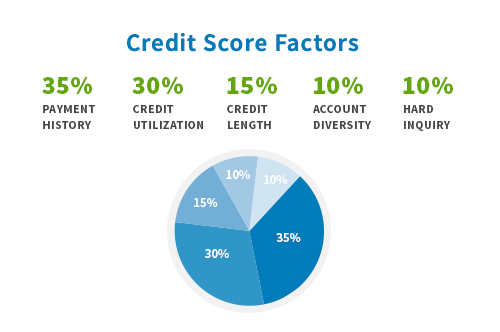

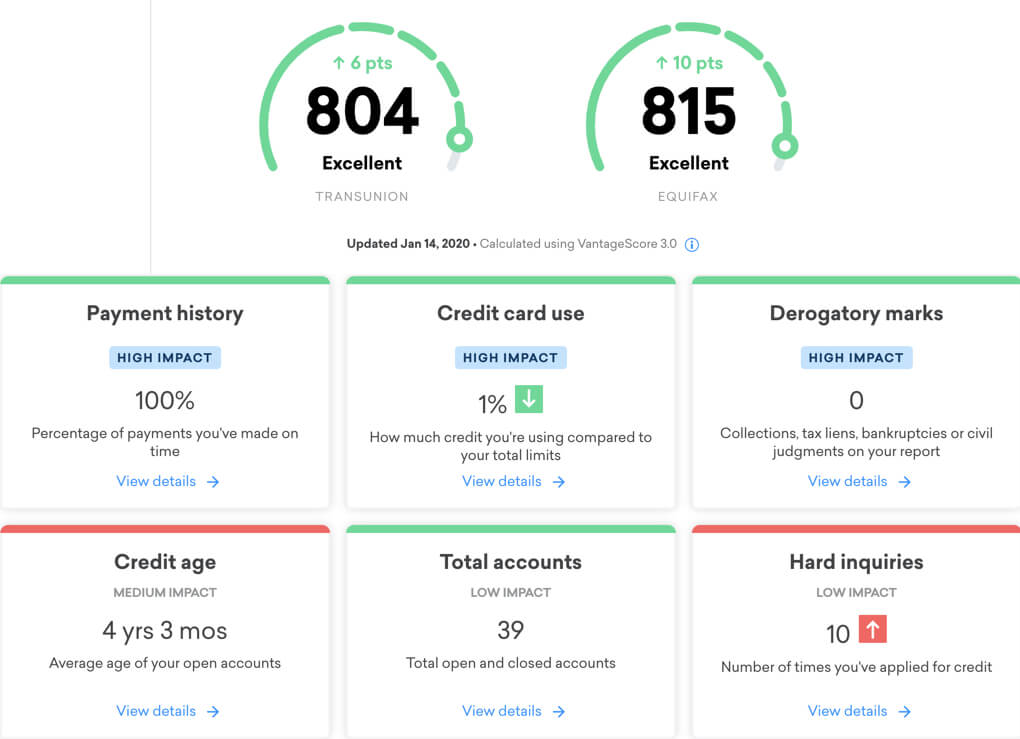

Vive financial faqs credit cards. Your credit utilization rate also referred to as your utilization ratio is the second most important factor in credit scores. Consistently pay bills on time every month. Do not max out or even coming close to maxing out credit cards or other revolving credit accounts.

The consumer federation of america suggests these four actions for improving your credit score. Vive helps those with credit challenges enjoy lifes special moments and businesses save the sale and increase ticket size.

/cdn.vox-cdn.com/uploads/chorus_image/image/65374925/shutterstock_567634105.0.jpg)

/how-having-a-zero-balance-affects-your-credit-score-960530-v1-114f260e205b479ca394b027e1525721.jpg)

/how-opening-a-new-credit-card-affects-your-credit-score-96050-final-5b60bade46e0fb0025b3bc98.png)

/images/2019/06/10/credit-card-can-raise-your-credit-score.jpg)

/GettyImages-1041512942-a2f1ac7907a5458ea2f3bef5f98cb887.jpg)

:strip_icc()/how-opening-a-new-credit-card-affects-your-credit-score-96050-final-5b60bade46e0fb0025b3bc98.png)

/rapid-rescoring-to-raise-credit-scores-4144660-FINAL-5c1d95b9e00d44b8ad2e77529681d052.png)

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/arc-anglerfish-arc2-prod-gmg.s3.amazonaws.com/public/6GEDARI4NBFF5PXPHSWKZ7352I.jpg)